Retail Parks Market in Croatia

Retail parks have become one of the most attractive segments for investment in commercial real estate in Croatia over the past 3 years. Some of the main reasons for their rapid expansion are:

- Fast, simple, and inexpensive construction

- Lower service charge and utility costs compared to shopping centers

- Tenant mix targeting convenience shopping such as food, drugstores, and discount clothing and footwear stores, which are considered crisis-resistant and anti-cyclical

- Easy conversion options in case of poor performance (into DIY stores, warehouses, etc.)

Due to all the above-mentioned reasons, retail parks are an extremely interesting product for bank financing and to investors looking at passive forms of investment with stabilized operations and predictable cash flows.

Supply

- Over 50 retail parks operate in more than 40 cities across the country

- Almost all major cities are covered, from Zagreb with 5 open retail parks to cities with fewer than 10,000 inhabitants such as Krk, Ploče, Rakovica, Imotski, or Ludbreg

- Split is the only major city that still does not have a retail park, with the closest one being in Kaštel Sućurac and one planned in Dugopolje

- The average size of a retail park in Croatia is around 8,000 m² with 9 to 16 tenants

- The anchor tenant in 90% of cases is a grocery store, such as Spar, the leading retailer present in 40% of retail parks, usually accompanied by drugstores such as dm, Muller, Bipa, and discounters such as Tedi, Pepco, Kik, Deichmann, Mana, NKD

- The current occupancy rate in majority retail parks is 100%

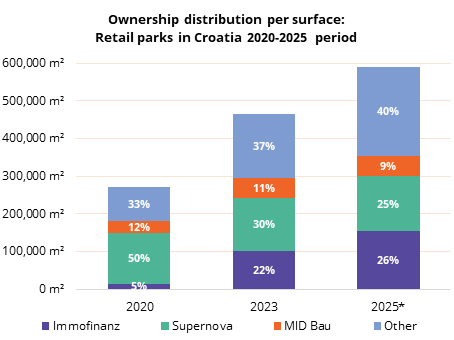

Between 2020 to 2023, the number of retail parks increased by about twenty, while their total area grew from approximately 260,000 m² to 460,000 m². Another twenty centers with a total area of 120,000 m² are under construction or have obtained location permits, indicating investors' belief that the market is not saturated and that there are locations in secondary or tertiary cities with good access roads for which there is tenant demand.

Ownership distribution

- The majority of the expansion was initiated with the expansion of the Stop Shop scheme portfolio owned by the Immofinanz group (recently part of the CPI Property Group), which increased its market share in the total area from 3% in 2020 to 22% in 2023 and could take over the leading position from Supernova by 2025 if it completes currently active projects

- Stop Shop and Supernova account for over 50% of the total area of all retail parks in Croatia, while the rest is divided among about twenty domestic and foreign investors

- Distribution per surface is 23% domestic, 77% foreign capital

The market is expanding, but certain micro-locations show signs of saturation, and it is questionable whether all retail parks will continue to operate positively after the expiration of the first 10 years of lease, which is the standard contract duration for such schemes.

In the coming period, we expect an increase in transaction activity in terms of ownership consolidation and the entry of new investors looking for properties with stable long-term leases that are easy to manage. The recent amendment to the Law on Pension Funds has enabled pension funds to invest in alternative forms of assets, and we can expect some funds to flow into this segment of commercial real estate.

Prepared by Avison Young Croatia: Avison Young is a global commercial real estate consultancy providing a wide range of services, including property valuation, feasibility studies, investment advisory, and transaction or lease brokerage. We also offer detailed market research services in all real estate segments.

Source: Avison Young research